Investing in Silver: Current Silver Oz Prices and How to Buy

How much is silver today? Silver costs about $32 per ounce. Silver prices change every day due to market forces.

Silver is a hedge against inflation and economic instability for many investors. Silver, like gold, holds its value throughout market instability. Some investors acquire silver expecting a big price increase.

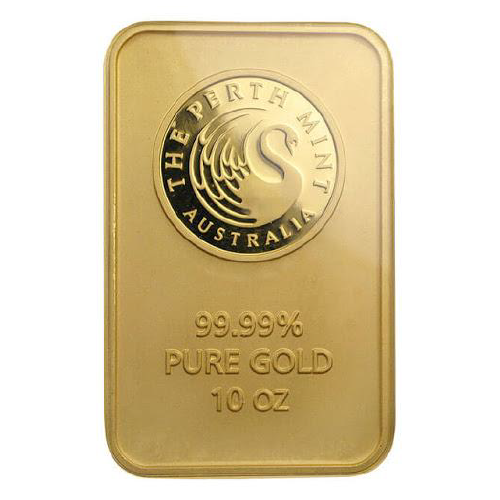

Silver bullion is pure silver bars, rounds, or ingots. Bullion is offered per troy ounce in various sizes. Choose Royal Canadian Mint or Sunshine Minting for optimal resale value. Bullion is available from precious metal merchants, coin shops, and internet vendors. Online precious metals merchants and coin stores sell them.

Pre-1965 silver coins are popular with collectors and investors because they contain 90% silver. Morgan Dollars, Peace Dollars, and Walking Liberty Half Dollars dominate. Silver coins cost more than the spot price but can appreciate over time owing to their collectability.

Buy silver ETFs like SLV, which monitors silver prices. This lets you buy silver without receiving it.

Buy silver mining stocks. Silver mining firms gain from rising prices. However, their stock values rely on numerous other variables, making this riskier than buying silver.

Trade silver options and futures. This lets you bet on silver prices. Again, this is risky and only for skilled investors.

Many analysts recommend investing in silver today due to its multi-year lows. Like any investment, silver prices may not grow. Silver is worth considering for inflation hedges and portfolio diversification.

You may acquire silver in several ways. Popular means for small investors to purchase silver: Silver should be bought while it's cheap and undervalued. Although 1-ounce silver price have grown dramatically in the previous decade, they are still affordable compared to gold. Demand for silver will drive prices up in the next years, according to most analysts. Following these strategies can help you benefit from this valuable metal.