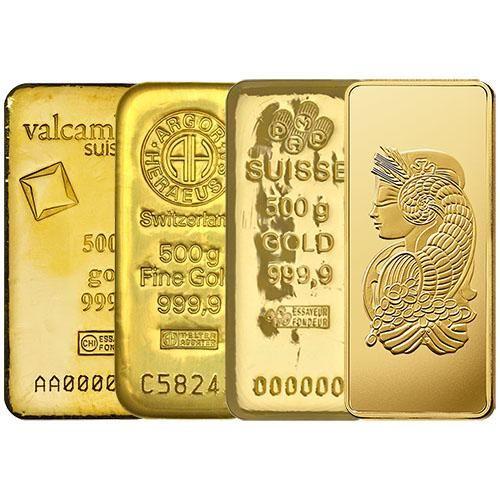

Why you should put your money into gold bullion

Gold that has been stored in bars or ingots is called gold bullion. The size and purity of the gold bar determine its value. For those who want to preserve their wealth and maintain their purchasing power, gold bullion is a popular investment. Gold bullion is a legitimate asset that can be safely stored in a bank's vault or safe. Additionally, it has an intrinsic value that is unaffected by economic crises or fluctuations in the currency. Due to its lack of correlation with other assets like stocks and bonds, investing in gold bullion also contributes to diversification. Gold bullion is an excellent option for investors looking for a secure and dependable investment because it is a timeless asset that can be passed down through generations.

A Brief History of Gold

Gold has been a valuable commodity since antiquity. Numerous civilizations, including the Egyptians, Romans, Aztecs, and Incas, placed a high value on it. Everything from coins and jewelry to religious artifacts and money was made of gold. As a symbol of power, wealth, and prestige, gold bullion has always held a special place in the hearts of many cultures. Gold is still used as an investment and value store today, and dealers also use it in a variety of industrial processes. Gold bars and coins have always had a special place in human history, regardless of how they are used.

Why You Should Buy Gold?

In recent years, there has been an increase in the demand for gold bars due to the rising wealth of developing nations. Many of these nations' cultures are deeply rooted in the use of Canadian gold. In China, where gold bars are frequently used for financial savings, gold has always been in high demand.

The fact that gold is typically valued in fiat currencies and, as a result, tends to rise alongside everything else when fiat currencies lose their purchasing power due to inflation is a foreclosure hedge. People may also be persuaded to purchase gold when they believe that the value of their local currency is decreasing because gold is regarded as a dependable store of value.

Protection from deflation In a deflationary phase, which has not occurred globally since the 1930s, prices fall when the economy is heavily indebted and corporate activity slows. When other prices fell significantly during the Great Depression, gold's relative purchasing power increased. This is because people preferred to keep cash in safes at the time, and gold and gold coins were the safest forms of currency.

Why should you buy gold coins and bars?

Buying gold could help you keep your money steady during tough economic times. Including gold in your portfolio could be advantageous due to the fact that it has been used as currency around the world for thousands of years. Buying actual gold bars and coins has numerous advantages. The two main benefits of investing in gold are safeguarding your wealth and diversifying your holdings. You might be able to sell gold bars and coins you've had for a while for a profit if the gold price goes up.