Where is the silver mined?

Even though silver is mined all over the world, Mexico produces most of it. It produced 6,118 tonnes (or nearly 200 million ounces) of silver in 2021, accounting for just shy of 25% of global production.

China and Peru are the only other nations producing more than 100 million ounces per year. In 2021, these three nations will account for just over half of all silver mined.

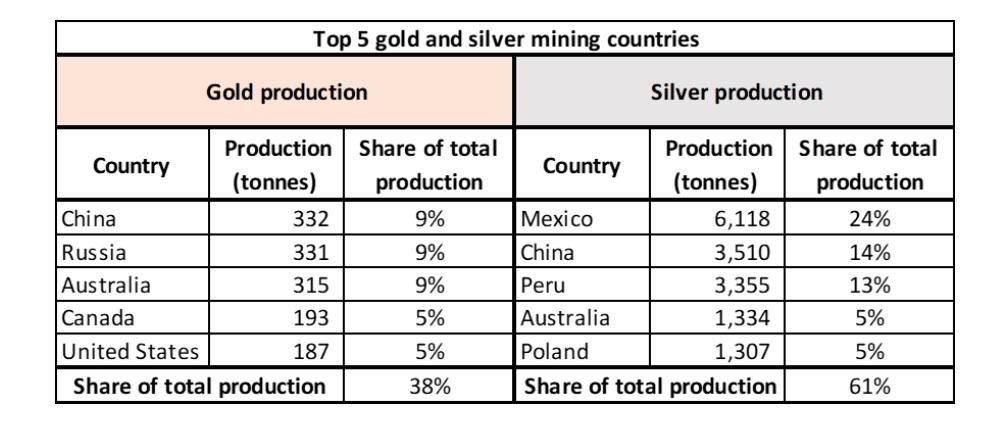

As the table below demonstrates, the largest five countries by mining production account for 61% of total silver mining output, compared to just 38% for gold. In this regard, silver mining is more concentrated than gold mining.

The only two nations that rank among the "Top 5" for both precious metals are China and Australia.

Silver is a side effect!

Another important difference between the supply of gold and silver is that most silver produced worldwide is actually a byproduct of mines that target other metals.

According to the 2022 World Silver Survey, lead-zinc, copper, and gold mines accounted for 72% of silver production. That is not the case with gold, which is typically the primary metal on which businesses focus when attempting to develop a mine.

Demand: Who purchases silver?

Like gold, silver draws in the venture from those looking to

support expansion risk

safeguard their portfolio when value markets decline

own a resource that can serious areas of strength for conveying term returns

Individuals additionally purchase silver in gems structure, where it goes about as both a showcase and store of riches, very much as they do with gold.

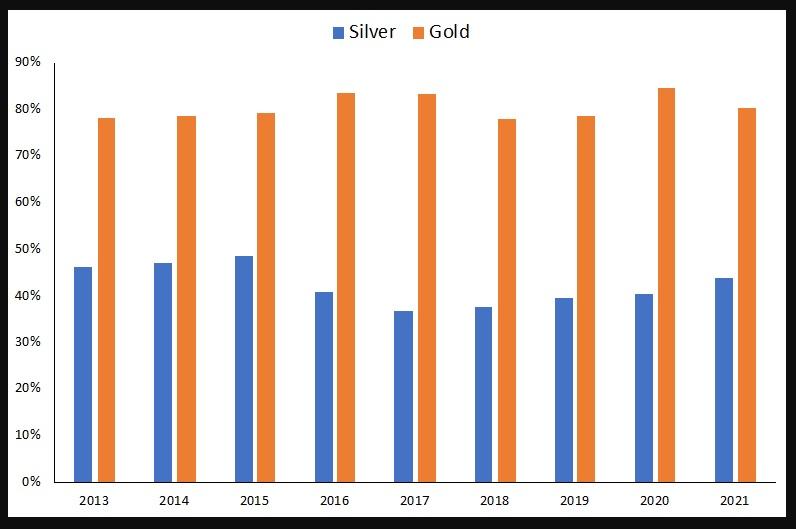

Where silver contrasts from gold is that as a portion of complete interest, the venture and gems part is far more modest, with a lot bigger portion of all out silver interest driven by its differed modern purposes.

This should be visible in the graph underneath, which shows the portion of all-out interest for both gold and silver that comes from speculation and gems requests.